JVViews: October 2015 Issue

President's Message

Early Morning Discussion - October 28, 2015

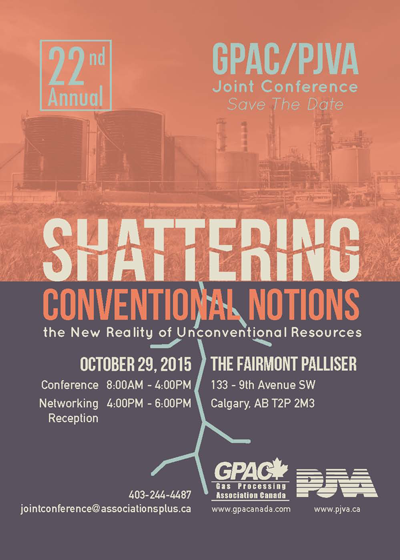

PJVA/GPAC Joint Conference: Shattering Conventional Notions – The New Reality of Unconventional Resources - October 29 at the Palliser Hotel

Annual Christmas Social

PJVA AIPN Article - October

Fall Pub Night Review

Membership Renewal Cutoff

Upcoming Events

Social Media

Member Benefits

President's Message

Petroleum Joint Venture Association Celebrates 30 Years!

2015 IS MAJOR MILESTONE FOR ASSOCIATION

PJVA is proud to report its 30th year as one of the premier associations in the oil and gas industry. For the past 30 years PJVA has achieved many innovations and has supported its membership with class and dignity. Over the next few months, the association will commemorate this historic occasion at many of the upcoming events.

In September of 1985 the association took flight when founding members:

Took the time to gather together and form the PJVA. The association had instant success on many levels. One of the first tasks taken on by the new group was standardizing the many service and ownership agreements in use at the time. These model agreements form one of the main foundations of what PJVA still stands for today.

Education was another driver for the early group and continues to drive the association today. PJVA has offered since 2005, continuing education certificate programs at Mount Royal University for Joint Venture Administrators and Analysts. In addition, JV e-Studies is also offered for those who do not require continuing education but still want to know how joint venture works in Western Canada.

The PJVA Board of Directors look at ways to continuously improve and enhance todays PJVA education portfolio. Some of those enhancements include diversifying to SAIT and a degree program for a Joint Venture Representative among other ideas currently in the research stage. There are several industry seminars available to both members and non-members. PJVA also offers many networking opportunities for its membership throughout the year.

Early Morning Discussion - October 28, 2015

8:00 am – 9:30 am (Doors open at 7:30 am)

Location: The Petroleum Club

319 - 5 Avenue SW, Card Room (Downstairs)

The New War on Talent

In recent years, there have been a number of rule changes that have redefined what contractors are into a number of separate groups. Our presentation will address these changes and how they affect independent contractors and companies who work with them. This will provide insight as to the risks and liabilities to both employers and contractors. We will also discuss what strategies can be used by progressive organizations and contractors.

If you are a contractor or considering becoming an independent contractor as a result of recent retirement or due to this economic environment, this session will be beneficial to you. Come with your questions.

The presenter is CEO Aly Bandali, CHRP. Aly has almost 20 years of executive management experience in the field of human resources. He has worked as an HR strategist in a variety of sectors, including oil and gas, energy, engineering, aviation, municipal government, private enterprise and not-for-profit. Aly has been chairman of the Canadian Council of HR Associations, HR Institute of Alberta and HR Association of Calgary. He has also served on the HR Committee of the Chamber of Commerce and the Executive Education Committee at the University of Alberta.

See the Event Page HerePJVA/GPAC Joint Conference

Last week to signup for the Joint Conference!

Conference WebsiteAnnual Christmas Social – November 26, 2015

Kick off 2016 by building on your network!

PJVA AIPN Article - October

Tracey Moore-Lewis – PJVA Education Director

Tony Cioni – AIPN – Canada Chapter Director

Michelle Thoen - PJVA Education Director

It’s Crunch Time!

If you have not already done so, it’s that time of the year that your company is reviewing its budget for 2016 (should be a good one!) and allocating funds to each asset team within the organization. From there, the asset team will work with the allocated amount it receives to establish capital and operating spending required for the asset. This is the time we need to work with our partners to seek their approval for the 2016 plans and approve the forecasted work.

Forecast or budgets are an estimate of future expenditures for a set period of time. They can include revenue and expenses, but most often they support forward looking project-based expenditures for your plant or facility. In our industry, either forecasts or budgets are typically required under a governing agreement. This is true irrespective of the model formed used (e.g. CAPL, PJVA, AIPN). These budgets or forecasts are put together in the fall for the next year thereby providing enough time and detail to partners so that they too can plan and budget.

Examining the scope of future projects is a planning process that identifies: priority areas of spending, wasteful expenditures and tighter financial controls. This process will help you achieve set goals for your company and your partners. This process also helps build knowledge in your area of operations and make balanced decisions involving development and planning.

Here is the language we often read in many PJVA contracts:

Operator shall consult with the Operating Committee from time to time with respect to decisions to be made for the conduct of Joint Operations, and Operator shall keep the Owners informed in a timely manner with respect to important or significant Joint Operations.

(r) "Forecast" means a written statement, initiated by Operator, of the Joint Operations which are anticipated to be conducted during the Forecast Period, together with a written statement of the estimated expenditures to be made in connection with such Joint Operations;

(s) "Forecast Period" means a period of one (1) Year, provided that if this Agreement does not come into effect as of the beginning of a Year, the first such period for the Year in which this Agreement comes into effect shall comprise the portion of such Year remaining after this Agreement comes into effect;

Forecasts

(a) As soon as practicable after the execution hereof, Operator shall submit to the Operating Committee for approval a Forecast for the Forecast Period. In each subsequent Year, Operator shall submit a Forecast for the Forecast Period to the Operating Committee for approval, on or before the end of the current Year. If the Operating Committee does not approve a Forecast, or any portion thereof, such Forecast or the portion thereof not approved, shall be revised by Operator in accordance with the instructions of the Operating Committee. A copy of each revised Forecast shall be promptly furnished to each Owner.

(b) Each Forecast shall include a detailed and specific description of expenditures therein, identifying Operating Costs and Capital Costs separately, and providing an estimate of Owner's Substances and Outside Substances to be handled by the Facility. Any single Operating Cost in excess of the single expenditure limit set forth in the Accounting Procedure for which the Operator requests approval through approval of the Forecast should be clearly and separately identified. Each Forecast shall also provide for comparison, a summary of the Forecast and a projection of expected final expenditures for the current Year.

(c) Approval of a Forecast shall constitute approval of all expenditures in accordance with this Agreement, except single Capital Cost expenditures in excess of the single expenditure limit set forth in the Accounting Procedure. If directed by the Operating Committee, separate approval for projects, categorized as Operating Costs, that have an estimated cost in excess of Operator's single expenditure limit set forth in the Accounting Procedure, shall be required.

You already know that a contract is an exchange of promises to do (or refrain from doing) a certain thing. Put another way, a contract is a binding agreement between two or more persons which gives rise to obligations that may be enforced by the courts. So, why does our industry seemingly bypass the contractual requirement to send forecasts or budgets? In pondering this question, we had four thoughts for the membership:

- Are companies simply unable to meet the October deadline? We believe that this is part of the problem. Most companies do not have their budgets approved internally until after the October deadline listed in the agreement. If this is the case for your company and for your partners, perhaps you should re-consider the deadline for forecasts/budgets? If this deadline were changed to realistically match with each company’s financial cycle, then these fiscal control points might better align.

- Another common issue amongst companies is that budgets/forecasts are done at a field level. Unless you make your field team aware of the budget commitments for each CO&O, it is very difficult for them to pull numbers out of a high level budget after the fact. This is a very common practice in the industry. One way to deal with this is to let your field team know the budget deadline for their information. This will help them to help you properly construct your budgets.

- Should you choose not to do a budget you could be putting yourself in a position where your partners do not have the funds to go forward with a project and as such production could be impacted. This will help partners accrue for upcoming projects. This leads to a final word about the model form contract that you might be working under.

- While the CAPL form operating procedure and other domestic contract models permit operators to payment from partners without a budget, other model form agreements do not. For example, the model form joint operating agreement for the Association of International Petroleum Negotiators (AIPN) requires budgets. Without a budget, it is not even possible for an operator to cash call its partners. Nor do forecasts suffice. The commercial assumption is that financial decisions should be made collaboratively by the partners, and should not fall under the operator’s general discretion. Once the partners have approved a budget, it effectively operates like a “contract within a contract”, and any partner who fails to fund its share of costs is subject to harsh remedies such as the forfeiture of its interest or dilution of its working interest at a steep discount rate.

Fall Pub Night Review

PJVA held its first kick-off pub night of the new year on September 24th at State & Main Restaurant & Bar. We had a great turnout of over 20+ PJVA members attend to mix and mingle amongst their peers. Please note that we will be having a Halloween theme pub night next month on October so stay tuned for the date/venue.

Membership Renewal Cutoff - October 31, 2015

Don’t be caught out of the loop – Renew your membership before you are dropped from the email list and the online directory!

Upcoming Events

Early Morning Discussion - October 28, 2015 - Register Here

November 26 – Annual Christmas Social - Register Here

December 1, 2015 – JV Audit course was postponed from Sept 22 to Dec 1st

Social Media

Member Benefits

Don’t forget to check out the Resources link of the website for Member Benefits.

PJVA was incorporated in 1985 to represent individuals and organizations involved in petroleum joint ventures. JVViews is published to keep members informed about upcoming PJVA and industry events, courses and seminars offered and/or sponsored by PJVA and current projects being facilitated by the Association.