May 2019

May PJVA LuncheonPetroleum Joint Venture Association Board of Directors Call for Nominations

JV Certificate Program Volunteers are required!

Early Morning Discussion May 29, 2019

Golf Networking Event

Communicating with the Agreements Task Force

Oilpatch hopes investment flows back to Alberta after big Kenney win

Cenovus says Alberta production curtailments are working, reports Q1 profit

CP Rail first-quarter profit rises 25 per cent on higher crude revenues

Save the Date! New Pad Site Sharing Agreement Seminar – June 5, 2019

May Luncheon

Pieridae Energy is proud to be a Canadian owned, fully-integrated LNG enterprise and is looking to build the $10 billion, 10 million tonnes per year Goldboro LNG liquefaction facility off the East Coast near Halifax to supply natural gas to Europe. The company expects to start construction activities in 2019 and ship first gas overseas to meet the global LNG shortfall in 2023/2024.

While Industry focus has been on the prospects for LNG on Canada’s West Coast via B.C., Pieridae has flown under the radar to advance their project, focused on transporting stranded gas from Western Canada east to Nova Scotia for export to premium priced European markets. Unlike many North American energy projects, Goldboro is fully permitted, with all regulatory, environmental, Canadian and US import/export and construction permits in place.

They’ve included First Nations in their plan for economic development and have signed a benefits agreement with the Assembly of Nova Scotia Mi’kmaq Chiefs ensuring the Mi’kmaq First Nation will benefit economically from the development, construction and operation of the Goldboro LNG project.

For more on Pieridae Energy and the Goldboro LNG project, join us for a presentation by Martin Bélanger — President, Operations & Engineering at Pieridae Energy on how “Pieridae Energy is Poised To Be The First LNG Company to Market in Canada” on May 16, 2019 from 11:30 am – 1:00 pm at The Calgary Petroleum Club.

For tickets go to – Secure Online Registration

Maureen McCall

PJVA Director- Programs-Luncheons

Petroleum Joint Venture Association Board of Directors Call for Nominations

The Petroleum Joint Venture Association (PJVA) requests a Call for Nominations to fill the following Board positions: Education Director, EMS Director, Membership/Volunteers Director, and Social Events Director. Each role has a minimum two year commitment to the Board.

Education Director

The Petroleum Joint Venture Association (PJVA) requests a Call for Nominations to fill the Board position of Education Director. This role has a minimum two year commitment to the Board.

Description of Portfolio

The Education Director is responsible for establishing and providing a fit for purpose training in a convenient lecture or online format for anyone requiring an understanding of JV principles.

Role and Responsibilities of Director

- Establish and adhere to an Education Portfolio budget for the PJVA in coordination with the Treasurer

- Jointly develop and implement an education strategy with other PJVA directors to increase visibility in industry

- Ensure quality and consistency in course offerings through timely course reviews

- Perform yearly Education Budgets for the eStudies Program and the in-class JV Certificate program.

- Maintain a classroom materials database/file

- Work with Exam Coordinator to ensure that the JV eStudies exams and the JV Certificate exams reflect the current material.

- Maintain contact lists for Education Committee, and other industry associations

- Solicit feedback from Industry, students and instructors and use this feedback to improve offerings

- Identify and contract with 3rd party contractors when required

- Manage 3rd Party contractors in terms of scope, budget and schedule

- Provide tools to course coordinators to facilitate course reviews

- Consult the Board regarding issues or questions requiring approval, that fall within the Education Program

Key Initiatives

Key Education initiatives identified for the 2019-20 year include:

- Continue to work towards strengthening of PJVA brand

- Establish, review and refresh the education framework for the Board

- Establish an annual education plan, manage the education organization chart, and adhere to the annual budget

- Identify opportunities for joint education with other industry associations

- Identify new education avenues for PJVA

Experience

- Must be a current PJVA Member

- Minimum 3 years industry experience or other relevant post-secondary education and/or technical certification

- Confident in public speaking

- Ability to think ahead, meet deadlines, work under pressure, and be accountable

- Ability to motivate and manage volunteers

- Ability to interact professionally and with confidence regarding all aspects of PJVA and JV business to other associations and businesses

Expectations

- Attend monthly Board meetings and provide Education portfolio updates

- Passion to support industry colleagues and promote the PJVA brand

- Willingness to dedicate 5 to 10 hours per month to this role and supporting the PJVA Board

- Work to develop education opportunities with other associations as required from time to time

Early Morning Sessions (EMS) Director

The Petroleum Joint Venture Association (PJVA) requests a Call for Nominations to fill the Board position of EMS Director. This role has a minimum two year commitment to the Board.

Description of Portfolio

The EMS Director is responsible for the facilitation of sessions of PJVA members to discuss topics of interest and relevance to industry.

Role and Responsibilities of Director

- Establish and adhere to an EMS Portfolio budget for the PJVA in coordination with the Treasurer

- Jointly develop and implement a marketing strategy with other PJVA directors to increase visibility in industry

- Organize and facilitate up to eight (8) discussion sessions in each term

- Determine topics of interest for each session based on personal, Board and PJVA membership input

- Arrange for qualified persons to moderate each session

- Work with the Marketing Director to raise awareness of each session and grow attendance

- Work closely with PJVA staff and venue personnel to ensure audio-visual and other aids/materials are set up and ready for each session

- Introduce topic and moderator(s) at each session

Key Initiatives

Key EMS initiatives identified for the 2019-20 year include:

- Increase attendance of sessions through a diverse range of topics and by considering alternate times and locations

Experience

- Must be a current PJVA Member

- Minimum 3 years industry experience or other relevant post-secondary education and/or technical certification

- Confident in public speaking

- Ability to think ahead, meet deadlines, work under pressure, and be accountable

- Ability to motivate and manage volunteers

- Ability to interact professionally and with confidence regarding all aspects of PJVA and JV business to other associations and businesses

Expectations

- Attend monthly Board meetings and provide EMS portfolio updates

- Passion to support industry colleagues and promote the PJVA brand

- Willingness to dedicate 5 to 10 hours per month to this role and supporting the PJVA Board

- Canvas PJVA membership for topics of discussion and prevalence

Membership/Volunteers Director

The Petroleum Joint Venture Association (PJVA) requests a Call for Nominations to fill the Board position of Membership/Volunteers Director. This role has a minimum two year commitment to the portfolio and Board.

Description of Portfolio

The Membership/Volunteers Director is responsible for managing membership and volunteer lists on behalf of the Board and developing plans and strategies to match volunteers to other Board members’ requirements.

Role and Responsibilities of Director

- Establish and adhere to a Membership/Volunteers Portfolio budget for the PJVA in coordination with the Treasurer

- Jointly develop and implement a membership/volunteer strategy with other PJVA directors to increase visibility in industry

- Ensure quality and consistency of PJVA Membership/Volunteers materials and announcements

- Maintain and expand contact lists/database for all PJVA Membership/Volunteers contacts

- Work with Directors to track performance metrics to assess effectiveness of volunteers’ efforts and drive continuous improvement of volunteers’ plan

- Solicit feedback from industry and membership to improve and enhance PJVA strategies at a Board level

- Provide monthly updates to Board on Membership/Volunteers ongoing initiatives

- Engage in speaking opportunities, when necessary

Key Intiatives

Key Membership/Volunteers initiatives identified for the 2019-20 year include:

- Continue to work towards strengthening of PJVA brand

- Review and establish Membership/Volunteers framework for the Board

- Establish an annual Membership/Volunteers plan and assist in budgeting for Director Portfolios, as applicable

- Identify new Membership/Volunteers strategies - avenues for PJVA

Experience

- Must be a current PJVA Member

- Minimum 3 years industry experience or other relevant post-secondary education and/or technical certification

- Confident in public speaking

- Ability to think ahead, meet deadlines, work under pressure, and be accountable

- Ability to motivate and manage volunteers

- Ability to interact professionally and with confidence regarding all aspects of PJVA and JV business to other associations and businesses

Expectations

- Attend monthly Board meetings and provide Membership/Volunteers portfolio updates

- Passion to support industry colleagues and promote the PJVA brand

- Willingness to dedicate 5 to 10 hours per month to this role and supporting the PJVA Board

Social Events Director

The Petroleum Joint Venture Association (PJVA) requests a Call for Nominations to fill the Board position of Social Events Director. This role has a minimum two year commitment to the Board.

Description of Portfolio

The Social Events Director is responsible for proposing, coordinating, managing and hosting PJVA social events for our membership to promote PJVA values and establish strong relationships amongst membership.

Role and Responsibilities of Director

- Establish and adhere to a Social Events Portfolio budget for the PJVA in coordination with the Treasurer

- Jointly develop and implement a social events strategy with other PJVA directors to increase visibility in industry

- Plan and execute all PJVA social events throughout the year

- Monitor membership feedback to social events to ensure that the PJVA offers relevant and meaningful events

- Coordinate marketing activities for the social events with the Marketing Director

- Engage in speaking opportunities, when necessary

Key Intiatives

Key Social initiatives identified for the 2019-20 year include:

- Continue to work towards strengthening of PJVA brand

- Seek ways to Increase attendance rates at PJVA social events

- Planning and execution of key PJVA events, including:

- Christmas Social

- Stampede Event

- Golf Tournament

- Volunteer Recognition Lunch

- Research, planning and execution of new possible social events, including, but not limited to:

- Curling bonspiel

- Bowling event

- Scotch tasting

- Roughnecks partnership

- Other initiatives

Experience

- Must be a current PJVA Member

- Minimum 3 years industry experience or other relevant post-secondary education and/or technical certification

- Confident in public speaking

- Ability to think ahead, meet deadlines, work under pressure, and be accountable

- Ability to motivate and manage volunteers

- Ability to negotiate and manage social event contracts in a cost-effective manner

- Ability to interact professionally and with confidence regarding all aspects of PJVA and JV business to other associations and businesses

Expectations

- Attend monthly Board meetings and provide Social Events portfolio updates

- Passion to support industry colleagues and promote the PJVA brand

- Willingness to dedicate 5 to 10 hours per month to this role and supporting the PJVA Board

JV Certificate Program Volunteers

JV Certificate Program Volunteers required!

Volunteers are required for the JV Certificate Program as follows:

- Course Coordinator - JV Agreements course

- All course review committees

These are longer term commitments – ideally, you will be ready to stay in the role for 1 or more years.

Time per week: 2 – 5 hours/month, varying based on work required and number of committee members available

Experience required should be as follows:

JV Agreements Course Coordinator:

- 5+ years’ progressive experience and have completed the JV Administration Certificate program,

- 5+ years practical and progressive experience in a JV Administrator role;

OR

Committee member:

- 2+ years’ experience with completion of the JV Administration or JV Analyst Certificate Program;

- 5+ years’ experience in a JV Administrator or JV Analyst role

OR

Ideal candidates for these roles exhibit some or all of the following skills:

- Able to work in a confidential manner;

- Have current, relevant, industry experience and an understanding of the current PJVA Model agreements in use;

- The ability to identify, research and summarize information from various sources;

- Able to write new material, or edit existing materials, in a clear and concise manner suitable for use as an educational resource.

ALL interested PJVA members are welcomed to submit their names to Helen O’Brien (Helen.Obrien@huskyenergy.com) for any of these roles – your unique combination of experience, background, and skills might be exactly what is needed for the ongoing development and maintenance of our course materials.

Early Morning Discussion

Early Morning Discussion May 29, 2019

The Petroleum Club, Viking Room

7:30 am: coffee/networking. 8:00 am - 9:30 am: discussion

Golf Networking Event

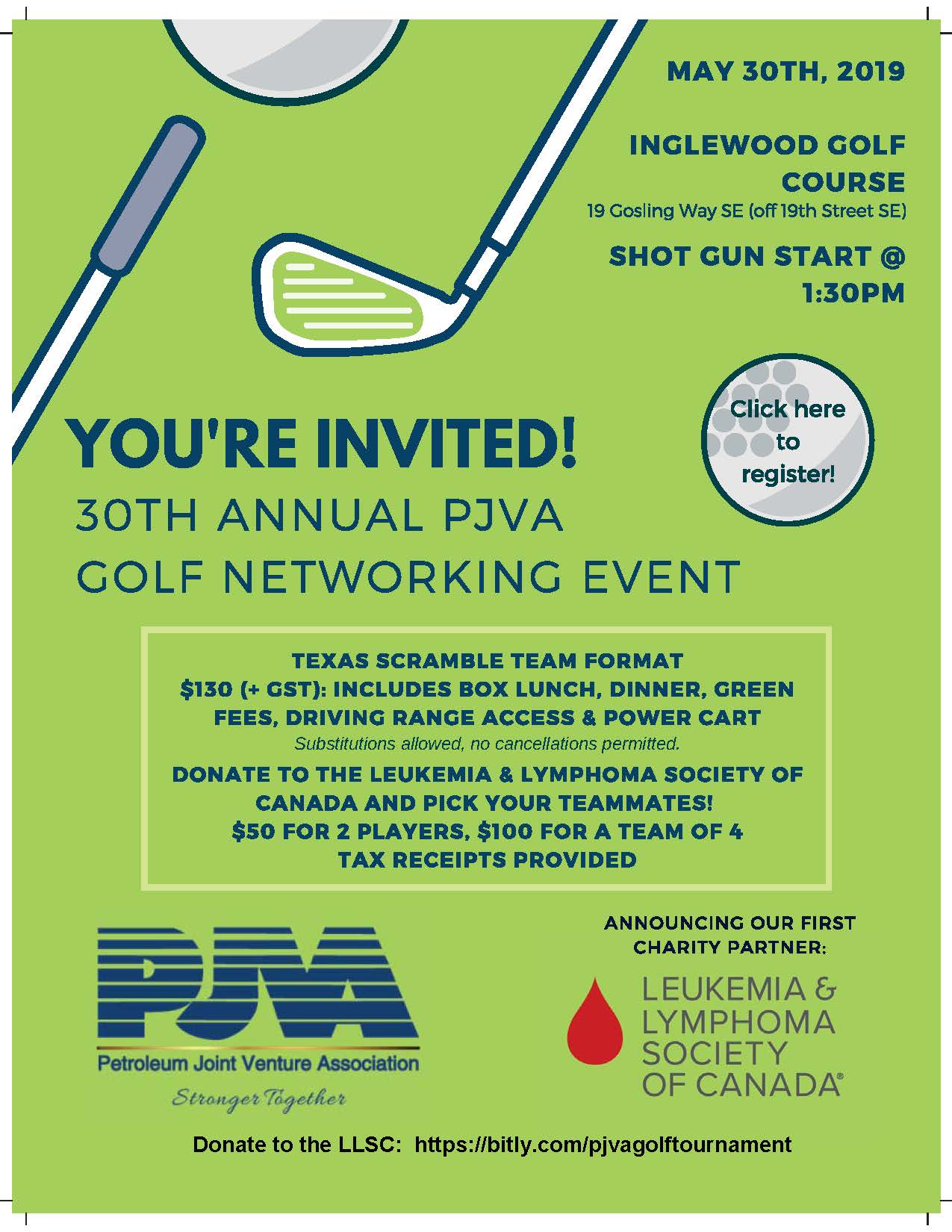

We are proud to be partnering with the Leukemia & Lymphoma Society of Canada for our 30th annual Golf Networking Event! It's an afternoon shot gun on Thursday, May 30th at Inglewood Golf & Curling Club. You can register online at https://lnkd.in/gKFKBnu

Communicating with the Agreements Task Force

Following up on a parting remark regarding questions regarding the Pad-Site Sharing Agreement which was rolled-out on the 25th of September, PJVA has created and will be monitoring the email address taskforce@pjva.ca. Please feel free to submit your questions and comments regarding the PSSA and/or any other agreements currently in use. We will be compiling and forwarding the comments to the various groups for response.

As the goal of this method is to make this process as easy on our volunteers as possible, we ask that you submit your questions/comments/suggestions in the following subject line format.

"YYYY Agreement – comment"

For example if you wish to have clarification around "seepage and pollution" insurance as mentioned in Article V, Clause 502 of Exhibit A to the PSSA please title the email by this same or similar convention.

"2018 PSSA – Exhibit "A" 502 "seepage and pollution"

On behalf of the PJVA, thank you very much for your comments

John Downey

PJVA - Director Task Forces

Oilpatch hopes investment flows back to Alberta after big Kenney win

*Article written by Kyle Bakx, and originally published by the CBC News, April 17, 2019.

It's exactly what many oil and gas companies wanted to see, despite how much credit they give Rachel Notley for her performance during her single term in power. “Hopefully we can start getting some positive results,” says energy company CEO.

After four years of declining investment in Alberta's oil and gas sector, the industry is hopeful a swift change in government will bring an equally quick return of fortunes for the oilpatch. Voters showed Rachel Notley's NDP the door on Tuesday; Jason Kenney's United Conservative Party will now have a majority government. It's exactly what many oil and gas companies wanted to see, despite how much credit they give Notley for her performance during her single term in power.

In the last couple of years, Tamarack Valley Energy CEO Brian Schmidt has struggled to attract investors when he holds meeting in places like New York. A new provincial government could be enough for pent-up investment dollars, and the accompanying jobs, to start flowing into Alberta.

"Finally, we have something they will look at as positive," said Schmidt. "For investment, this gives a big boost to our jurisdiction. Notley consistently tried her best to support the industry amid low oil prices,” he say, but he has more trust in Kenney to streamline regulations and to fight off federal government policies that could hurt the sector.

“Kenney's promise to set up a "war room" to defend the sector against misinformation and attacks on social media and elsewhere is important, as is a fresh approach to getting pipelines built,” said Tristan Goodman, President of the Explorers and Producers Association of Canada.

Notley tried to work with all stakeholders to build support for more pipelines, while Kenney has signaled, he'll be much more combative in dealing with opponents.

"Notley did a lot of work to try to underpin why we should move forward with pipelines and, unfortunately, that wasn't supported, I don't think, by the federal government," said Goodman.

During the campaign, the UCP pledged to get rid of the carbon tax and all other policies that are part of the NDP's climate plan, including the accelerated phase-out of coal-fired power plants and a cap on total oilsands emissions.

The party also vowed to replace the entire board of the Alberta Energy Regulator, and to streamline the agency to reduce the amount of red tape for oil and gas companies wanting to drill new wells or build new oilsands projects.

"There's no question that I think there are opportunities to look a little deeper [at] some of the streamlining, and just reducing some of the duplication that has occurred over the last several years," said Goodman.

In addition, Kenney vowed to stop Notley's plan to lease thousands of oil-tank railcars and has threatened to turn off the supply of oil to B.C. if the province continues to obstruct construction of the Trans Mountain pipeline expansion.

After stubbornly low commodity prices since late 2014, the value of Alberta oil has stabilized recently. Since the beginning of January, when the Alberta government's mandated cuts to oil production began, heavy oil in the province has sold for more than $40 US per barrel and even climbed above $50 this month.

There is, however, some skepticism about what a Kenney victory will mean for the oilpatch. U.S.-based political risk analysis and consulting firm Eurasia Group said in a report last week that investors in the Canadian energy sector should brace for "significant risks" following a Kenney victory, especially if Prime Minister Justin Trudeau's Liberal government is re-elected this fall.

"A Kenney-Trudeau showdown over energy and climate policy raises a number of significant risks for investors, as further delays, lawsuits and federal-provincial negotiations will make final resolution of key policy issues and project approvals harder to achieve," the Eurasia report said.

As much as Kenney vowed to fight for the oilpatch as he toured the province during the campaign, he also routinely criticized large oil companies in the country, mainly because of their support of a carbon tax.

In Alberta, the larger oil and gas companies are more likely to support a carbon tax or climate policy than small or medium-sized companies. Kenney's critiques were an unusual strategy, said experts, considering premiers of the province have usually gone out of their way to court support from energy-industry leaders.

While business has picked up in recent months at Performance Energy Services, CEO Scott Darling expects Kenney's victory will inject further optimism into the oilpatch. Admittedly, he said, he's pretty happy with the election result.

All of Kenney's advocacy for getting more pipelines built to improve the province's sluggish economy appeals to him. Darling is also counting on investors around North America to take notice.

"[Investors in] Toronto, New York and those places have been just petrified of us for a while," he said. "Hopefully we can start getting some positive results."

Schmidt, with Tamarack Valley Energy, expects Kenney's win to translate into more meetings with investors and better luck with them buying back into the sector. "How fast and how hard they come in — that's what remains to be seen."

*The newsletter may contain material sourced from to third party websites. The material is provided solely as a convenience to you and not as an endorsement by PJVA of the contents on such third party Websites. PJVA is not responsible for the content of third party sourced material and does not make any representations regarding the content or accuracy of materials on such third party Websites, or the availability of such Websites. If you decide to access third party Websites, you do so at your own risk.

Cenovus says Alberta production curtailments are working, reports Q1 profit

*Article originally published by The Canadian Press April 25, 2019

CALGARY — Cenovus Energy Inc. reported a profit of $110 million in its first quarter compared with a loss a year ago as it benefited from improved prices for western Canadian oil. The company says the improvement in prices for western Canadian oil due to the Alberta government’s curtailment program more than offset the impact of reduced production and increased operating costs during the first quarter.

Cenovus says its profit amounted to nine cents per share for the three months ended March 31, compared with a loss of $654 million or 53 cents per share a year ago. Gross sales totaled nearly $5.2 billion, up from $4.7 billion in the same quarter last year. Cenovus reported first-quarter oil sands production of 342,980 barrels per day, down five per cent compared with a year ago, while operating costs rose to $9.06 per barrel compared with $8.78 a year ago.

Production from the company’s Deep Basin assets averaged 104,290 barrels of oil equivalent per day, down 18 per cent from a year ago due to the sale of its Pipestone business, lower capital investment, natural declines and weather-related outages.

*The newsletter may contain material sourced from to third party websites. The material is provided solely as a convenience to you and not as an endorsement by PJVA of the contents on such third party Websites. PJVA is not responsible for the content of third party sourced material and does not make any representations regarding the content or accuracy of materials on such third party Websites, or the availability of such Websites. If you decide to access third party Websites, you do so at your own risk.

CP Rail first-quarter profit rises 25 per cent on higher crude revenues

*Article originally published by EnergyNow Media, April 24, 2019

CALGARY — Canadian Pacific Railway Ltd. saw profits shoot up last quarter as crude-by-rail revenues increased and fuel costs declined.

The Calgary-based company says its net income rose 25 per cent to $434 million in the quarter ended March 31, compared to $348 million in the same period in 2018. Quarterly revenues jumped to $1.77 billion, up six per cent from $1.66 billion last year. On an adjusted basis, year-over-year diluted earnings per share rose three per cent to $2.79 from $2.70, far short of analyst expectations of $3.01, according to Thomson Reuters Eikon. Revenues for energy, chemicals and plastics jumped 18 per cent to $315 million amid surging demand from Asian markets in the first quarter. Grain revenues, which have broken company records recently, rose six per cent to $380 million, and container traffic and coal nudged up three per cent and four per cent to $380 million and $158 million, respectively.

CP Rail’s operating ratio, a key industry metric, improved by 180 basis points to 69.3 per cent.

*The newsletter may contain material sourced from to third party websites. The material is provided solely as a convenience to you and not as an endorsement by PJVA of the contents on such third party Websites. PJVA is not responsible for the content of third party sourced material and does not make any representations regarding the content or accuracy of materials on such third party Websites, or the availability of such Websites. If you decide to access third party Websites, you do so at your own risk.

Save The Date!

New Pad Site Sharing Agreement Seminar – A Joint Session by PJVA & CAPL

Wednesday, June 5, 2019 to be held at the CAPL classroom (1600, 520 – 5 Avenue SW)

Instructor: Michael Bruch

Time: 8:00 am Registration/Continental Breakfast

8:30 am – 4:00 pm Seminar

Fees: $300(+gst) CAPL and PJVA Membership/Volunteers $400 (+gst) Nonmembers

Industry is increasingly drilling from shared well pads in which wells and facilities are not held in common interests. The PSSA provides the documentation and operating framework to address the wide range of issues inherent in a pad sharing scenario. There is an integration of JV and Land concepts in the PSSA that requires Land personnel to become more familiar with JV concepts and JV personal to become more familiar with Land concepts.

Seating is limited so please email your interest to Connie pjva@pjva.ca as soon as possible. Once the minimum numbers are reached, the registration link will open here.

Consider a Corporate Sponsorship with PJVA?

Is your company interested in a Corporate Sponsorship of PJVA? Do you know the benefits of being a Corporate Sponsor?

For further details please contact Jana Prete – PJVA Director or Connie Pruden at the PJVA office.

Upcoming Events

PJVA Luncheon

May 16, 2019

PJVA EMS

May 29, 2019

PJVA 30th Annual Golf Networking Event

May 30, 2019