June 2021

EMS and Board Election, June 17, 2021

Membership Renewal 2021-2022

31st Annual Golf Networking Event – September 15, 2021

Analysis: When Do Electric Vehicles Become Cleaner Than Gasoline Cars?

ESG Investing is the Future of Oil – David Yager

Canada Day

JV Certificate Program Courses begin with JV Agreements - September 7

Early Morning Session and Board Election - June 17, 2021

The EMS covered Change of Operatorship as a result of an Acquisition & Disposition transaction. A timely open discussion, it covered specific mail ballot scenarios, and also the specific details regarding an interim Operator.

Prior to the EMS, there was an election to fill positions for the 2021 – 2022 Board of Directors. Portfolios that were subject to election were the Task Forces Director, Marketing and Publicity Director, and the Treasurer.

While the new Board members are yet to be appointed, once they have been, each one will be featured in the “Who’s On Board?” section of JV Views on a monthly basis.

Peter Mitchelmore

PJVA Newsletter Editor

Membership Renewal 2021-2022 Now Due

As Canada Day is also the official start of the new fiscal year, it would be ideal to renew PJVA membership. Notices have already been sent to members; please contact the PJVA office if any assistance is required.

31st Annual Golf Networking Event

Save the Date! September 15, 2021 at the Inglewood Golf & Curling Club. Details to be shared with PJVA members once confirmed.

Analysis: When do electric vehicles become cleaner than gasoline cars?

Published by Reuters and republished by EnergyNow June 29, 2021

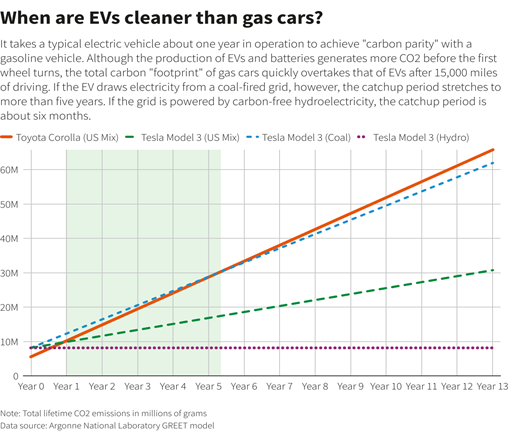

DETROIT, June 29 (Reuters) – You glide silently out of the Tesla (TSLA.O) showroom in your sleek new electric Model 3, satisfied you’re looking great and doing your bit for the planet. But keep going – you’ll have to drive another 13,500 miles (21,725 km) before you’re doing less harm to the environment than a gas-guzzling saloon.

That’s the result of a Reuters analysis of data from a model that calculates the lifetime emissions of vehicles, a hotly debated issue that’s taking center stage as governments around the world push for greener transport to meet climate targets.

The model was developed by the Argonne National Laboratory in Chicago and includes thousands of parameters from the type metals in an electric

vehicle (EV) battery to the amount of aluminium or plastic in a car.

Argonne’s Greenhouse Gases, Regulated Emissions and Energy Use in

Technologies (GREET) model is now being used with other tools to help shape policy at the U.S. Environmental Protection Agency (EPA) and the California

Air Resources Board, the two main regulators of vehicle emissions in the United States.

Jarod Cory Kelly, principal energy systems analyst at Argonne, said making EVs generates more carbon than combustion engine cars, mainly due to the extraction and processing of minerals in EV batteries and production of the power cells. But estimates as to how big that carbon gap is when a car is first sold and where the “break-even” point comes for EVs during their lifetime can vary widely, depending on the assumptions. Kelly said the payback period then depends on factors such as the size of the EV’s battery, the fuel economy of a gasoline car and how the power used to charge an EV is generated.

NORWAY’S A WINNER

Reuters plugged a series of variables into the Argonne model, which had more than 43,000 users as of 2021, to come up with some answers.

The Tesla 3 scenario above was for driving in the United States, where 23% of electricity comes from coal-fired plants, with a 54 kilowatt-hour (kWh) battery and a cathode made of nickel, cobalt and aluminum, among other variables. It was up against a gasoline-fueled Toyota Corolla weighing 2,955 pounds with a fuel efficiency of 33 miles per gallon. It was assumed both vehicles would travel 173,151 miles during their lifetimes.

But if the same Tesla was being driven in Norway, which generates almost all its electricity from renewable hydropower, the break-even point would come after just 8,400 miles. If the electricity to recharge the EV comes entirely from coal, which generates the majority of the power in countries such as China and Poland, you would have to drive 78,700 miles to reach carbon parity with the Corolla, according to the Reuters analysis of data generated by Argonne’s model.

The Reuters analysis showed that the production of a mid-sized EV saloon generates 47 grams of carbon dioxide (CO2) per mile during the extraction and production process, or more than 8.1 million grams before it reaches the first customer.

By comparison, a similar gasoline vehicle generates 32 grams per mile, or more than 5.5 million grams. Michael Wang, senior scientist and director of the Systems Assessment Center at Argonne’s Energy Systems division, said EVs then generally emit far less carbon over a 12-year lifespan.

Even in the worst case scenario where an EV is charged only from a coal-fired grid, it would generate an extra 4.1 million grams of carbon a year while a comparable gasoline car would produce over 4.6 million grams, the Reuters analysis showed.

‘WELL-TO-WHEEL’

The EPA told Reuters it uses GREET to help evaluate standards for renewable fuel and vehicle greenhouse gases while the California

Air Resources Board uses the model to help assess compliance with the state’s low-carbon fuel standard.

The EPA said it also used Argonne’s GREET to develop an online program that allows U.S. consumers to estimate the emissions from EVs based on the fuels used to generate electric power in their area. https://bit.ly/3y1fBnr

The results of the Reuters analysis are similar to those in a life-cycle assessment of electric and combustion-engine vehicles in Europe by research group IHS Markit.

Its “well-to-wheel” study showed the typical break-even point in carbon emissions for EVs was about 15,000 to 20,000 miles, depending on the country, according to Vijay Subramanian, IHS Markit’s global director of carbon dioxide (CO2) compliance.

He said using such an approach showed there were long-term benefits from shifting to electric vehicles. Some are less positive about EVs.

University of Liege researcher Damien Ernst said in 2019 that the typical EV would have to travel nearly 700,000 km before it emitted less CO2 than a comparable gasoline vehicle. He later revised his figures down. Now, he estimates the break-even point could be between 67,000 km and 151,000 km. Ernst told Reuters he did not plan to change those findings, which were based on a different set of data and assumptions than in Argonne’s model.

Some other groups also continue to argue that EVs are not necessarily cleaner or greener than fossil-fueled cars. The American Petroleum Institute, which represents over 600 companies in the oil industry, states on its website: “Multiple studies show that, on a life-cycle basis, different automobile powertrains result in similar greenhouse gas emissions.”

Argonne National Laboratory is funded by the U.S. Department of Energy and operated by the University of Chicago.

*The newsletter may contain material sourced from to third party websites. The material is provided solely as a convenience to you and not as an endorsement by PJVA of the contents on such third-party Websites. PJVA is not responsible for the content of third-party sourced material and does not make any representations regarding the content or accuracy of materials on such third-party Websites, or the availability of such Websites. If you decide to access third party websites, you do so at your own risk.

ESG Investing is the Future of Oil – David Yager

Written by David Yager and published by EnergyNow July 1, 2021

The opponents of oil have done everything they can think of to precipitate the permanent decline of this essential industry.

It isn’t working very well, at least not yet. While the critics of fossil fuels have had some success in western countries at reducing market access and supply, on a global basis none of these efforts have materially impacted demand.

A June 24th Reuters article titled “Reducing oil use to meet climate targets is tougher than cutting supply” tells the story. “Governments around the world have been slow to take uncomfortable decisions to persuade consumers to cut energy consumption to help achieve climate targets, often because consumers are not ready to pay up or compromise their lifestyles.”

Citing the International Energy Agency’s recent report that stated the development of new fossil fuels supplies must stop immediately, the article quoted IEA boss Fatih Birol who said, “Consumer behavior needs to change as a result of government steps.” Reuters continued, “Birol said the IEA has over 400 milestones that need to happen to achieve net zero targets by 2050 and 95% of those milestones should be driven by changes in demand, not supply.”

With the oil industry being the top stock market performer this year, it’s appropriate to review the ESG investment phenomenon. We’ve been assured this is a powerful tool to use money and capital markets to force oil, gas, and coal producers to change their behavior or do something else.

ESG started with the fossil fuel divestment movement when it became morally reprehensible to invest in coal, oil or gas companies. The early advocates were on university campuses where students tried to force university endowment funds to dump fossil fuel stocks.

Public and private sector pension funds were next, and the pressure is relentless. Corporate Knights, a website that promotes “Clean Capitalism”, continued on June 24, 2021, with an article titled, “Why are Canadian pensions risking our future by funding fossil fuel expansion?” which will surely result in “…catastrophic climate change.”

Then the financial sector got involved by introducing climate risk into investment decisions. In 2017 Michael Bloomberg and Mark Carney were the driving forces behind the Task Force on Climate-Related Financial Disclosures (TCFC). The right thing to do for responsible corporate governance was to acknowledge that large scale decarbonization of the future energy complex or severe weather events could have a material impact on a company’s prospects. This should be included in corporate planning and disclosure. TCFC was quickly endorsed by many institutional investors.

This morphed into today’s ESG investing; Environmental, Social and Governance. ESG covers climate change and all the other things that things modern corporations should pursue such as diversity and gender equity. While profits remain important, companies must do good or be seen as doing good. And fossil fuels are bad. Starting with climate activists then expanding to ordinary investors, there has been growing pressure to support ESG investing. Because fossil fuels have joined tobacco, alcohol, gambling, sex, and defense contractors as the business sectors that the morally enlightened should either avoid or thoroughly explore before investing.

I have spent decades as a senior executive with TSX-listed oil service companies travelling to the financial centers of North America trying to persuade banks and institutional investors to provide us with expansion capital. Vancouver, Montreal, Toronto, New York, Boston, Chicago, San Francisco, Houston. I have two lasting observations.

The first is that none of the people I dealt with appeared to have chosen a career in financial services as an outlet for their inherent social altruism. It seemed to be more about making a lot of money. The second is that the senior executives leading these firms were the best salespeople I have ever met. Big bucks attract the best and brightest.

In the past few years there have been many headlines about banks and institutional investors declaring they would no longer provide financial support for certain fossil fuel developments. It started with big European banks announcing that they would quit funding new coal or oil sands projects. This has expanded to include a growing array of institutional investors that say they will decline providing financial support for fossil fuel developers that are not adjusting their business and behavior to the climate change challenge.

In the last year, many of the bigger oil producers have changed their public disclosures and corporate strategies. Legacy global supermajors Shell and BP led the way in 2020 with restated mandates to move from oil into other forms of energy. Many large producers have publicly endorsed the net zero by 2050 pledge, although the honest ones admit they have no idea how they will achieve it. Recent events affecting Shell in Dutch courts and the annual shareholder meetings of ExxonMobil and Chevron in the US could leave many with the impression that public concerns about climate change and ESG investing is accelerating the energy transition away from fossil fuels.

Much lower and highly volatile commodity prices since 2014 have made it much easier for banks and institutional investors to publicly adopt ESG principles, avoid the oil and gas industry, attract capital from climate-concerned investors and shareholders, and continue to deliver growing profits and returns. For broad-based funds and banks (which by nature are multi-sector generalists), not investing in oil and gas for the past five years has had much more to do with economic necessity than moral persuasion. Along the way, the marketing wizards concluded that signaling their ESG credentials was a good way to keep new capital coming in and/or maintain current shareholders or investors.

There are two elements of the ESG investing story that run contrary to what is often reported. The first is that oil and gas prices are not only out of the dumpster, but many years of low capital investment and continued demand growth have completely changed global energy markets. Now people are talking about $100 oil, not $20.

If ESG investing has had any impact at all, restricting capital has ensured companies have had less to spend on reserve development which has helped contribute to what many believe is a pending supply shortage. While is seems unlikely, is it possible fund managers were smart enough to predict or influence this outcome?

Equity markets are enjoying steady growth this year thanks to the end of pandemic lockdowns, pent up consumer demand, reopening of businesses, and massive stimulus spending by western governments. The other is the quest for sustained yield or dividends. One thing oil and gas has proven when commodity prices are higher is that well managed producers are cash machines.

Research firm Rystad Energy released a report on June 23 titled with press release titled, “A record cash flow is brewing for the world’s public E&Ps in 2021 as US shale delvers super-profits”. Rystad reports, “Their combined FCF (Free Cash Flow before financing or hedging) is expected to surge to US$348 billion this year, with the previous high being US$311 billion back in 2008.”

If you read the fine print in the public pronouncements on both sides of the ESG trade, the common term is “capital discipline”. This means producers are no longer pursuing their historic goal of growing production to meet future demand growth. In fact, the question is being raised if enough capital has been invested in the past five years to offset future reservoir decline rates. If demand doesn’t decline, a shortage is inevitable.

And whatever the long-term goal of ESG investors is, those who hold oil stocks want to see sustained or increased dividends as much as reserve growth or an entirely new business model. At least for now. Recent events with ExxonMobil and Chevron reveal that 2021 ESG investing includes owning oil and gas stocks so long as management says and does the right things. Right now, E&P equities are becoming increasingly attractive as both the yield and the underlying share value are increasing.

Everyone should decide where they want to invest when the world returns to normal. Normal includes government stimulative spending being replaced by tax increases, the end of pent-up consumer demand after a year of pandemic lockups, and the developing world continuing to grow its population, GDP, and energy consumption.

The performance of the western economy has been supported by years of uber-low interest rates and “quantitative easing”. Markets shuddered only a week ago when the US Federal Reserve publicly speculated about tapering quantitative easing sooner than previously announced because of rising inflation.

Equity markets love it when governments print and spend money. At least in the short term, which is the 21st century investment time horizon.

What stocks do you want to own when the party ends? The stuff people can’t live without, like resources. If fossil fuels remain profitable while other sectors of the economy flatten or contract, will banks and equity investors remain as ESG focused as they have been in the past few years? Can they afford to be?

As for oil, whatever we’re told we’re supposed to do about decarbonization, the reality is that non-OECD producers from Eastern Europe, the Middle East, Africa, Asia and South America have the capability of filling any supply shortages incurred by the influence of ESG investing on E&Ps headquartered in the EU or North America.

What does ESG investing mean for the Canadian oilpatch in the short and medium term? Thanks to higher prices it is evolving into neutral or positive.

Producers that are saying and doing the right things are again able to raise money. With positive cash flow from existing production, doors to new debt and equity will surely open. While the public narrative is that investors have been avoiding the sector, the reality is that the industry was a lousy investment for many years. Companies without free positive cash flow can’t borrow money no matter what business they are in.

ESG capital for energy alternatives and decarbonization of the existing oil and gas supply chain is fantastic if that’s what investors and policy makers want. This is a source capital than never used to exist. This funding will be much more predictable and easier to access for entrepreneurs with good ideas than more government programs.

The long term, however, looks murkier. The quest for yield and reduced capital spending will create problems. Reserve replacement is a key component of staying in the oil business. Looking to the future, before the recent board changes ExxonMobil was planning to increase production. While the new direction as reflected by new board members is said to be good for mankind from an emissions perspective – and higher prices and dividends are certainly good for shareholders – really high oil prices have proven to negatively affect humanity in many other ways. Like the cost of food.

The elephant in the room remains Asset Retirement Obligations, or ARO. This is rarely mentioned in the media except to repeat somebody’s complaints. But ARO is becoming more important as investors select the companies they choose to support. The oil and gas industry is expected to clean up after itself. All producers carry ARO liabilities on their balance sheets. Even if oil is ultimately doomed in the long term, the world will be a better place if E&P companies are left with enough cash to ensure cleaning up their “stranded assets” doesn’t become somebody else’s problem.

Will the current crop of ESG shareholders still be around when the time comes to properly shutter expired or worthless fossil fuel assets? If E&P companies switch to renewables, can they develop new clean energy sources and still generate enough cash flow to pay dividends and decommission their legacy assets? Under the environmental rules of 10, 20 and 30 years from now?

This is yet another reason to include oil and gas producers in the energy transition, not squeeze them out.

As the first generation of wind and solar renewable electricity assets reaches the end of their practical service life, the ARO issue is emerging in this sector. Hopefully, the playing field will be level as that industry matures. Developing renewables properly on a full cycle basis including ARO will increase the cost. Can we be confident ESG investors will be equally rigorous in their expectations of renewable energy producers?

ESG investing and the future of oil. As with all aspects of climate change, the real issues are much more complex than politics, virtue signaling and the daily news.

*The newsletter may contain material sourced from to third party websites. The material is provided solely as a convenience to you and not as an endorsement by PJVA of the contents on such third-party Websites. PJVA is not responsible for the content of third-party sourced material and does not make any representations regarding the content or accuracy of materials on such third-party Websites, or the availability of such Websites. If you decide to access third party websites, you do so at your own risk.

Canada Day

Belatedly, on behalf of PJVA, I hope that all members enjoyed Canada Day. As the lockdown is due to be finished by the end of the year, there should be a gradual/staged return to in-person events. That would entail fully resuming the fulfillment of PJVA’s motto.

Peter Mitchelmore

PJVA Newsletter Editor

JV Certificate Program - JV Agreements runs September 7 – October 7, 2021

This course provides you with an opportunity to learn about Petroleum Joint Venture Agreements and expand your oil and gas knowledge base. You will learn how to negotiate and advance Joint Ventures, the business of which is documented in a number of agreements. This course will provide you with an advanced understanding of fees, facilities, and movement of production through them. Most importantly, you will achieve a firm understanding of agreements required to capture the business arrangements such as Construction, Ownership and Operation (CO&O), Unit Agreements, Unit Operating Agreements and a variety of Service Agreements.

More info or Register here today